Commentary on the Market: Third Quarter Update 2020

Ruben’s Commentary on the Market

Third Quarter Market Review 2020

The third quarter of 2020 has given us much to talk about and many things which cause concern for most of us that follow the news. Let me first begin with a struggling economy. The contributing factors are high unemployment, a global pandemic caused by the COVID-19 virus with no current end in sight, and of course the contentious political climate. I will address these issues and perhaps add some perspective as to how they impact the future of the financial markets.

Overall, the economy is running without the benefit of a full tank of gas. Although the U.S. has replaced 11.4 million jobs of the 22 million lost to the pandemic, we still have a long way to go. This currently constitutes an overall unemployment rate of over 8%. I have stated in many of my quarterly updates that jobs and personal spending are key drivers of a thriving economy. Spending at the retail level travels up the food chain to manufacturing and service industries. Momentum will continue at a slower level until the virus is markedly under control or a vaccine is widely distributed. Neither outcome appears likely in 2020.

This lack of momentum underscores comments made recently by Federal Reserve Chairman, Jerome Powell. He laid out a new policy vision for the Fed; one where rather than keep a 2% cap on inflation, the Fed would allow inflation to exceed 2% in order to play catchup once the economy begins to revive. They will in part achieve this by keeping interest rates at historically low levels in order to make borrowing less painful and easier to access. This action could extend as far out as 2023. In an article publisher October 6, 2020 in the Wall Street Journal, Chairman Powell warned of “potentially tragic economic consequences if Congress and the White House don’t provide additional support to households and businesses disrupted by the coronavirus pandemic.” He additionally stated that the risks of providing too generous relief are smaller. “Even if policy actions ultimately prove to be greater than needed, they will not go to waste.”

Lastly, let us get to the elephants in the room, the markets and the presidential elections. The markets have been volatile in recent months, waiting to see the outcome of the upcoming elections, the potential for another stimulus package, and an effective treatment for the coronavirus.

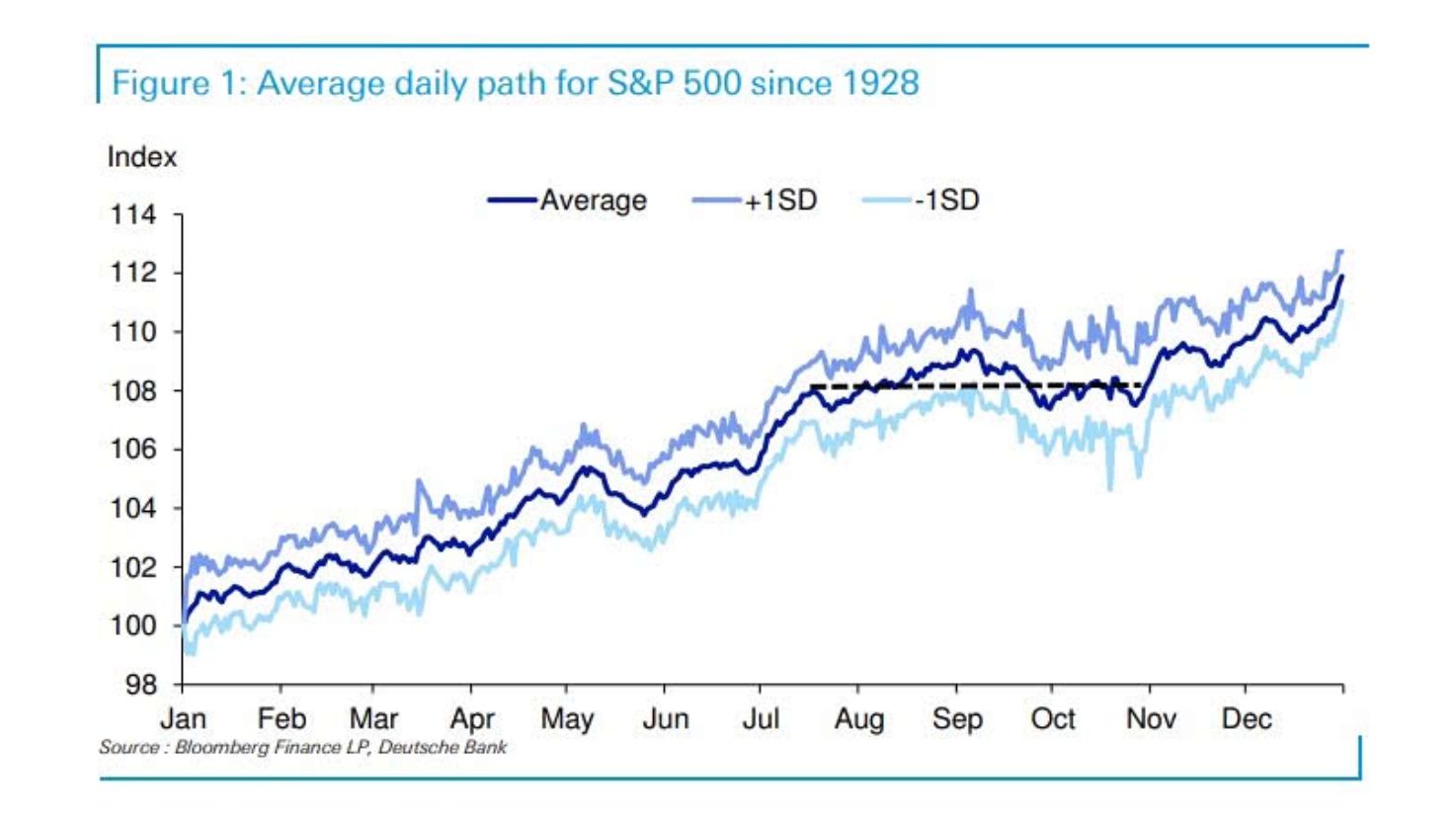

Deutsche Bank strategist Jim Reid noted in a recent commentary that volatility has tended to be highest in October historically, only to settle down as prices rally during the final two months of the year. “Markets have traditionally not tended to care who wins the election, they just want certainty.” Below is a chart Reid provided through Bloomberg Finance that tracks the S&P 500 dating back to 1928 which shows this historical theme year after year. There is no other way to interpret this chart. Simply put, stocks started the year at a certain level and followed a bumpy path only to end the year much higher in most instances.

This is certainly an unusual year with all the turmoil that we have experienced. However, we should keep in mind that since 1928 many bad things have happened. There have been wars, civil unrest, natural disasters, financial crises, and of course, viral outbreaks. We as investors should not ignore these experiences. Volatility and uncertainty are not uncommon in investing. In good times and bad times, we all want a better life. These wants and needs create the resilience that drives the growth and innovation that in turn provides us investment opportunities.

Unless there are major changes in human and consumer psychology or big changes in how we do business, I feel strongly that the long-term outlook for stocks will continue to be positive.

Please don’t hesitate to reach out to me with any questions that you may have. I am happy to take your call or email.

My best to all,

Ruben E. Guerra